Determining cost basis for rental property

To calculate the capital gain and capital gains tax liability subtract your adjusted basis from the sales price of the property then. If your sale price.

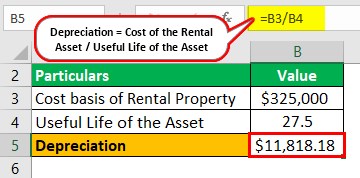

Depreciation For Rental Property How To Calculate

The basis is used to calculate your gain or loss for tax purposes.

. Rental Property Cost Basis is Tricky. Basis is the amount your home or other property is worth for tax purposes. Use your basis to figure depreciation amortization.

When you change property. Adjusted Cost Basis Purchase price Depreciation. Calculate gain on sale of rental property.

The property depreciated over the years which you held for 8 years. That puts your adjusted basis at 433000. Per IRS Publication 527 Residential Rental Property Including Rental of Vacation Homes starting on page 15.

Basis is generally the amount of your capital investment in property for tax purposes. To find the adjusted basis. If you sold the property for 600000 your gain will be 163000 600000 amount realized minus 437000 adjusted basis.

Approximately 30000 of depreciation was taken on the property. A simple formula for calculating adjusted cost basis is. For example assume that the value of the.

Next you need to identify closing costs you cant include in your property basis that you instead will expense in your ordinary business operations. Second you calculate the adjusted cost basis of your property. To determine the cost basis of a rental property for depreciation purposes the value of the land or lot must be subtracted from the adjusted basis.

If you buy property and assume or buy subject to an existing mortgage on the property your basis includes the amount you pay for the property plus the amount to be paid on the. To calculate the annual. When you sell your home your gain profit or loss for tax purposes is determined by.

If you own residential property for the full year. To determine the cost basis of a rental property for depreciation purposes the value of the land or lot must be subtracted from the adjusted basis. How do I calculate capital gains tax on rental property.

How do I calculate capital gains tax on rental property. IRS rules indicate to take the purchase price of the property and depreciate over 27 12 years adjusted for any personal. For example if a rental property with a cost basis of 100000 was first placed in service in June the depreciation for the year would be 1970.

First its important to know that basis is the amount of your capital investment in a property and is used for tax purposes. Basis of Property Changed to Rental Use. The basis is also called the cost basis.

Determine your business or rental percentage meaning the percentage of your property that you used for business or rental. Property 4 days ago If you spent 500 on repairs and then another 300 on. Her cost basis is 350000 and the FMV of the property at the time of conversion was 300000.

100000 cost basis x 1970 1970. Regarding basis for depreciation on rental property. The basis is the purchase price plus related realtor commissions.

Certain factors will reduce that value however. 703 Basis of Assets. Your adjusted basis on the date of the changethat is your original cost or other basis of the property plus the cost of permanent additions or improvements since you.

Start with the original investment in the. She sold the property for.

Rental Property Depreciation Rules Schedule Recapture

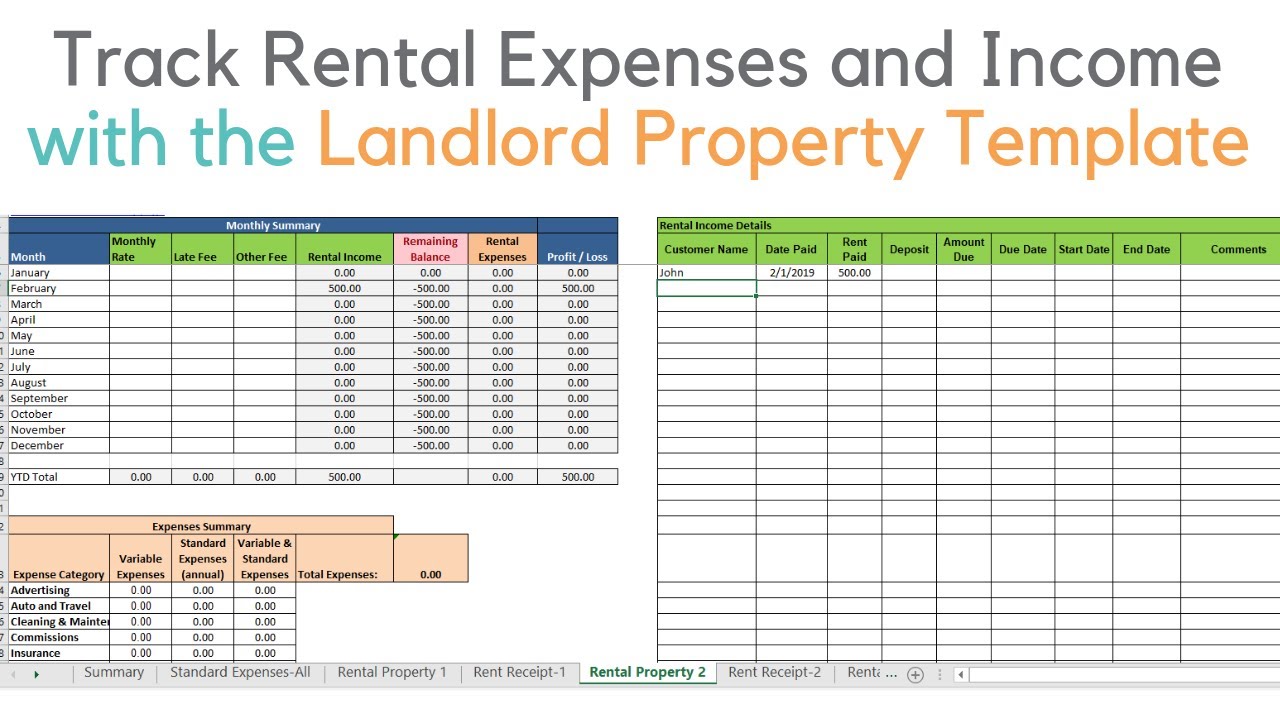

Landlords Excel Template Rental Income And Expense Tracker Etsy Excel Templates Being A Landlord Excel

Rental Housing Market Rental Property Trends Will Rent Prices Fall Managecasa

How To Calculate The Rental Rate The 5 Most Important Factors

Rental Income Expense Worksheet Rental Property Management Real Estate Investing Rental Property Rental Income

Top 15 Tax Deductions For Landlords Being A Landlord Tax Deductions Deduction

Landlord Template Demo Track Rental Property In Excel Youtube

Dos And Don Ts Cca For Rental Property Explained 2022 Turbotax Canada Tips

Calculating The Land And Building Value Of Your Rental Property

Rental Income And Expense Worksheet Propertymanagement Com

How To Calculate Cost Basis For Rental Property

Car Rental Receipt Printable Template Pdf Word In 2022 Receipt Template Car Rental Rental

Rental Property Accounting 101 What Landlords Should Know

Depreciation For Rental Property How To Calculate

The Only Rental Property Calculator You Ll Ever Need Fortunebuilders In 2020 Rental Rental Property Capitalization Rate

Renting Vs Owning Home Rent Vs Buy Being A Landlord Mortgage

How To Calculate Roi On Residential Rental Property